Now Reading: Trump wants to eliminate $7,500 electric-car tax credit

-

01

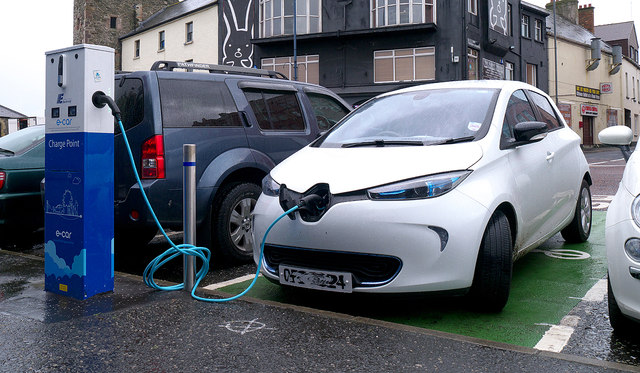

Trump wants to eliminate $7,500 electric-car tax credit

Trump wants to eliminate $7,500 electric-car tax credit

President Donald Trump wants to eliminate the federal tax credit that gives up to $7,500 to buyers of electric cars.

In a $4.7 trillion budget proposal for the 2020 fiscal year, Trump stated removing the electric vehicle tax credit that has become a common target for conservative lawmakers in recent times would save $2.5 billion over 10 years.

Present regulations permit automakers to provide credits for up to 200,000 electric vehicles per manufacturer. No less than two significant manufacturers, General Motors and Tesla Inc, have reached the limit and they have lobbied for an elimination of the cap.

General Motors pushed back on the tax-credit removal.

The president’s budget propositions are probably going to run into strong resistance in Congress with Democrats controlling the U.S. House of Representatives. Lawmakers are not committed to follow a president’s budget requests, and Congress routinely rejected Trump’s fiscal recommendations even when Republicans were in charge of both chambers.

Trump’s budget also calls for the removal of the Advanced Technology Vehicles Manufacturing loan program and other Department of Energy programs he considers “costly, wasteful or duplicative.”

The program has been utilized by Ford Motor to upgrade facilities in Illinois, Kentucky, Michigan, Missouri, New York

Nissan utilized a $1.45 billion loan in 2010 to construct plants for advanced battery manufacturing and environmentally friendly paint and to modify its Smyrna, Tennessee, plant for assembly of the all-electric Leaf.

Tesla utilized a $465 million loan in January 2010 on its manufacturing facility in Fremont, California, to produce battery packs, electric motors and other powertrain components for all-electric vehicles.

Trump stated in his budget proposal that the “private sector is better positioned to provide financing for the deployment” of commercially important projects.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG -

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return -

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque -

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-155x125.jpg) 042027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]

042027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery] -

052026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units

052026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units -

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range -

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-700x394.jpg)