Now Reading: US Congress Lets Go of 8000 Tax Credit for Hydrogen Vehicles

-

01

US Congress Lets Go of 8000 Tax Credit for Hydrogen Vehicles

US Congress Lets Go of 8000 Tax Credit for Hydrogen Vehicles

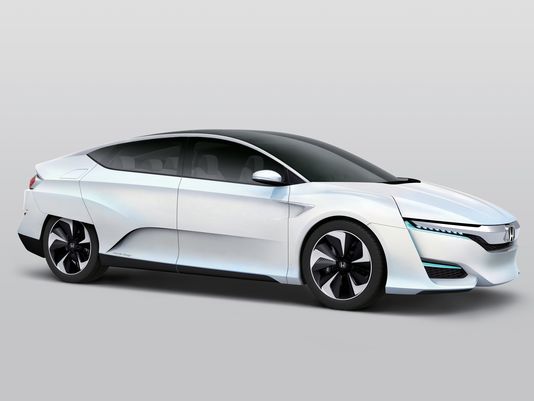

Last month, when the Japanese automaker Toyota officially introduced the Mirai FCV, a hydrogen fuel cell vehicle, the company was quoted mentioning buyers of the car would have to pay a tax credit of $8,000, more or less. However, speaking of this tax credit, one thing comes to mind. It is set to expire when the year 2014 comes to an end. This looks to be even more so as there has yet to be any update whatsoever in respect to the legislation related to the tax credit.

Taking that into consideration, it seems that those who spend their cash on the Japanese hydrogen fuel cell vehicle may be able to save $8,000, at least twelve months from now. This is all seemingly because the US Congress has not managed to keep up with the trends in the fast growing automotive industry.

Speaking of this particular tax credit system in the US, the Autoblog Green reports that the US Congress has actually worked in close collaboration with PIA as well as other similar organizations. Their collaboration focuses on extending the tax credit for electronic vehicle charging stations (EVSE). That information has been quoted from the senior policy advisor of Plug In America, Jay Friedland. According to Friedland, individual customers in the states have the ability to reduce up to 30% of the purchase and installation costs of the EVSE, which may go up to $1,000. As for corporate customers, they will be allowed to reduce the costs by up to $30,000. Friedland also mentions that this will apply to the hydrogen fuel cell vehicles purchased by the end of 2014 and it will act retroactively when the new year begins. As a matter of fact, Friedland even encourages the residents of the United States of America to go to the dealerships and spend their money on any hydrogen fuel cell vehicle of their choosing this Christmas season.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG -

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return -

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque -

042026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units

042026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units -

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-155x125.jpg) 052027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]

052027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery] -

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range -

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-700x394.jpg)