Now Reading: Mercedes to lift Aston Martin stake to up to 20 percent by 2023

-

01

Mercedes to lift Aston Martin stake to up to 20 percent by 2023

Mercedes to lift Aston Martin stake to up to 20 percent by 2023

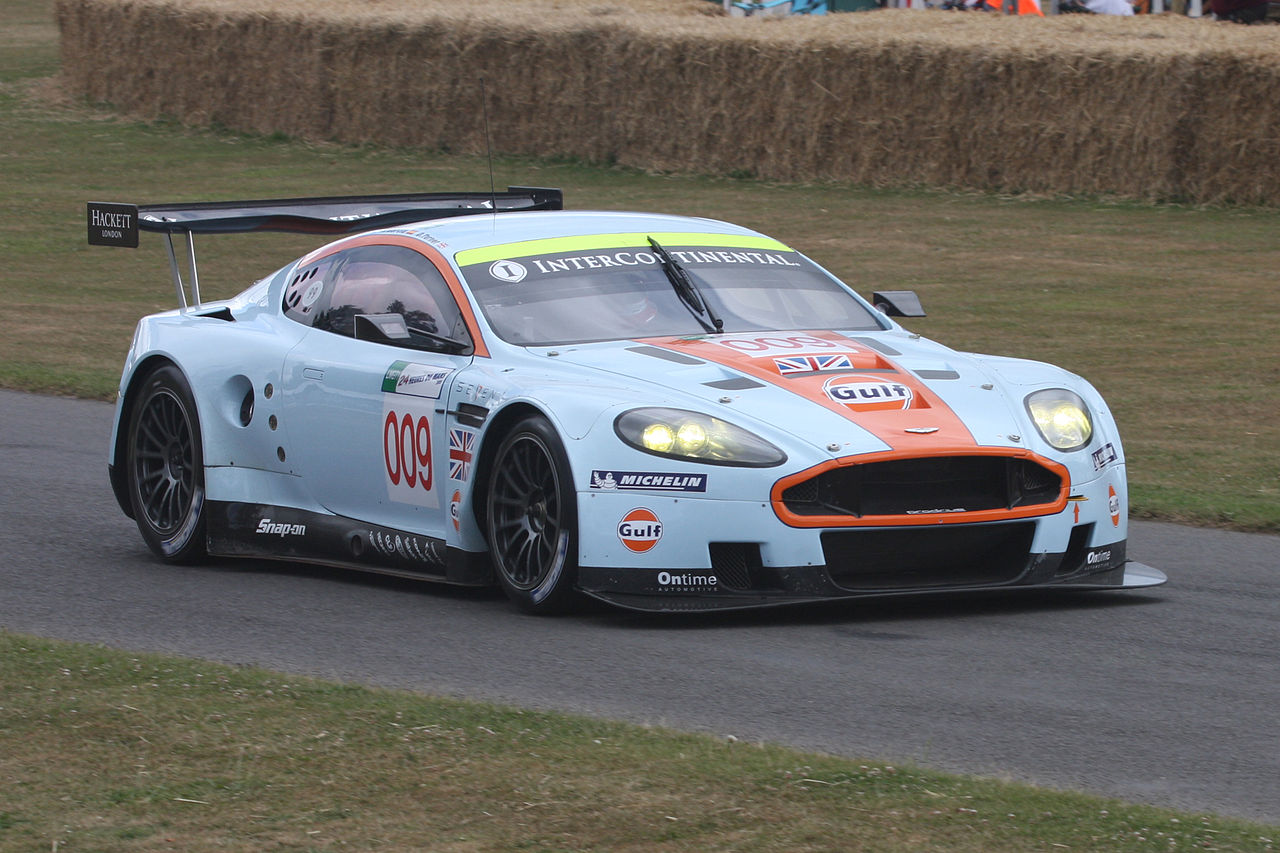

Daimler owned Mercedes-Benz is to lift its stake in the luxury automaker, Aston Martin, to up to 20% by 2023, making it one of the automaker’s largest shareholders, Aston Martin said on Tuesday.

Aston Martin, popular for being James Bond’s automaker of choice, has gone through a torrid time since it floated two years ago, with its shares losing two-thirds of their value in 2020.

The automaker hired Tobias Moers, former CEO of Mercedes-AMG, as its new boss from August.

Aston said the boost in Mercedes-Benz’s stake, from 2.6% at this moment, would take place in several stages as part of a broader issue of 250 million shares at 50 pence each.

It said that the stock issued to the German group will have a maximum value of 286 million pounds ($371.8 million).

The deal will see an existing supply agreement between the two companies, in place since 2013, expanded to give Aston Martin access to key Mercedes’ technology, including hybrid and electric auto drive systems.

“We take another major step forward as our long-term partnership with Mercedes-Benz AG moves to another level, with them becoming one of the company’s largest shareholders,” said Lawrence Stroll, the chairman and biggest shareholder of Aston Martin.

The German automaker will get the opportunity to nominate one non-executive director to Aston Martin’s board after its first shareholding boost, the London-listed company said.

Aston, which has started to make the deliveries of its first sport-utility vehicle, the DBX, said on Tuesday it swung into an adjusted core loss of 29 million pounds ($37.7 million) in the third quarter, versus a profit of 43 million pounds ($55.9 million) last year.

Revenue in the period almost halved to 124 million pounds ($161.2 million), it said.

Aston Martin is targeting an annual capex of 250 million pounds ($325 million) to 300 million pounds ($390 million) per year between 2021 and 2025.

It predicts production volumes of about 10,000 units, earnings of about 2 billion pounds ($2.60 billion), and adjusted core profit of 500 million pounds by financial years 2024 or 2025.

Stay Informed With the Latest & Most Important News

Previous Post

Next Post

-

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG

01Polestar Boss Says It’s Time To Outrun BMW M And Mercedes-AMG -

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return

02Spy Shots: 2027 Mitsubishi Pajero Spotted in Testing Ahead of Possible U.S. Return -

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque

032026 Toyota Hilux EV: A Powerful Truck with Silent Torque -

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-155x125.jpg) 042027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]

042027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery] -

052026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units

052026 Corvette ZR1 Production Surges Past Expectations as Output Clears 1,000 Units -

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range

06Spy Photos: VW ID. Polo GTI Goes Electric with 223 HP and 280 Miles of Range -

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

07Hyundai Palisade’s Breakout Year Shows How Quickly the Market Can Turn

![2027 Mercedes-Benz S-Class Debuts with V8 Engine [Photo Gallery]](https://speedlux.com/wp-content/uploads/2026/01/2027-Mercedes-Benz-S-Class-33-700x394.jpg)